Bill McQuaker, Co-Head of Henderson’s Multi-Asset Team, provides his views on the proposed third bailout deal for Greece. The price is high and there are still legislative hurdles to overcome, but there is hope that Europe’s family will emerge stronger and wiser from this ordeal.

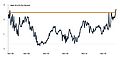

Like so many episodes of the long-running euro crisis, the latest one ended in a sea of green screens and a sigh of relief. Investors started to sense that a ‘Grexit’ might be avoided at the end of last week, sparking a sharp turnaround in markets. The weekend brought fresh discord, however, and at 7am on Monday morning it looked likely that markets would sell-off again. But, in the nick of time, a deal was announced. Markets opened higher and by the end of the day were almost 10% above the low point reached last week.

Summing it up

The agreement reached paves the way for a third bailout for Greece, with the value of the package estimated at between 80bn and 86bn euro. The deal will extend over several years and be funded by the European Stability Mechanism. Anyone thinking this represents a victory for Tsipras and Syriza should think again. The money will be used largely to repay existing loans, and the price paid by the Greeks for the package is predictably high. Greece has been given until Wednesday to pass new laws that will see value added tax (VAT) raised and pensions reduced. Automatic spending cuts will kick in if forecasts for primary budget surpluses are not achieved. In addition, assets owned by the Greek state will be put into a separate fund and sold off or leased out to generate fresh income. At one stage it was proposed that the money raised by the fund was to be used in its entirety to repay debt, but the final draft conceded that some of it may be used to recapitalise Greek banks and to fund growth initiatives. An additional concession in the draft was a reference to more European Union investment in Greece, although it is not clear how much of this is new money.

Family fortunes

Even now there are still hurdles to clear, as facilitating legislation must pass through the parliaments of other member states as well as through the Greek parliament. Recrimination and condemnation are widespread within Greece, in Europe and beyond. The saga may have been dealt with sufficiently well that politicians and bureaucrats can relax and enjoy a summer break. But whether this marks the end of the Greek issue is an entirely different question.

Optimists will argue that, when tested in earnest, the financial firewalls erected since 2012 have held firm. And indeed they did – peripheral bond spreads did not widen by much at any point over the last few months. However, those of a more guarded nature might reflect that, while the firewalls to financial contagion held strong, the coarse nature of the political conversation may have weakened the barriers to political contagion. ‘Project Europe’ was once about uniting the Continent around a set of high political aspirations. It is difficult to assess how much damage Greece has inflicted on this narrative, or whether Europe’s ‘family’ will emerge stronger, and wiser in the long run.

www.fixed-income.org

--------------------------------------------------

BONDBOOK Restrukturierung von Anleihen

Auf 104 Seiten werden detailliert alle wichtigen Hintergründe rund um die Restrukturierung von Anleihen für Unternehmen und Anleihegläubiger erläutert.

Die Ausgabe kann zum Preis von 29,00 Euro (inkl. USt. und Versand) beim Verlag oder im Buchhandel (ISBN 978-3-9813331-2-1) bestellt werden.

www.restrukturierung-von-anleihen.com

--------------------------------------------------